Violent Attack in Halle Leaves Three Injured, Including a Child

Police Probe Possible Links Between Göppingen Shooting and Stuttgart Gang Conflicts

Bielefeld Police Hunt for Suspect After Early Morning Stabbing

German Authorities on High Alert Following Early Morning Knife Attack in Bielefeld

Understanding ARFID: Beyond Picky Eating

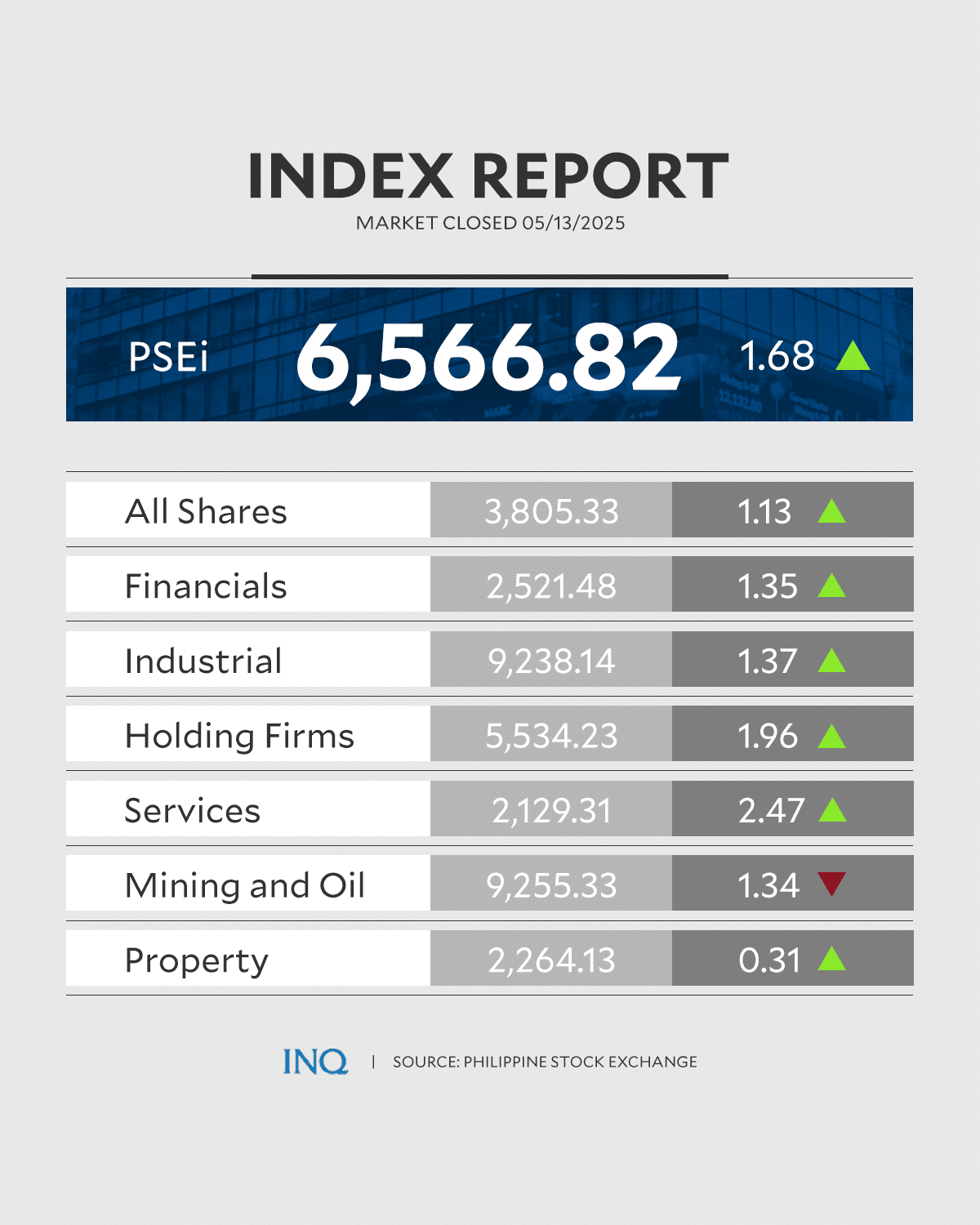

Philippine Stocks Surge Post-Election, Reflecting Investor Confidence

Malaysia's retail sector demonstrated a notable rebound in March, with sales growing by 6.6 percent year-on-year, according to recent data from the statistical office. This marks an improvement from February's 5.7 percent increase, though it still falls short of January's 8.2 percent growth. The resilience of the retail sector is underscored by the performance of non-specialized stores and other goods in specialized stores, which saw increases of 6.5 percent and 7.3 percent, respectively. Meanwhile, wholesale trade and motor vehicle sales also posted positive, albeit slower, growth rates.

In Seoul, the stock market experienced modest gains following the announcement of a trade agreement between the United States and China. The Korea Composite Stock Price Index (KOSPI) edged up by 0.04 percent, reflecting cautious optimism among investors. However, the local currency weakened against the U.S. dollar, and market heavyweights ended the day in mixed territory. The trade deal, which includes a 90-day tariff truce, has been met with a positive response on Wall Street, but its impact on Asian markets appears more nuanced.

The Philippine Stock Exchange Index (PSEi) enjoyed a significant uplift, closing at one of its highest levels this year after the country's 'generally peaceful' midterm elections. The benchmark index rose by 1.68 percent, with the broader All Shares Index also posting gains. This rally reflects investor confidence in the stability and predictability of the political environment, a crucial factor for market performance. Services firms led the charge, with International Container Terminal Services Inc. (ICTSI) surging by 5.71 percent, highlighting the sector's robust performance.

As markets across Asia respond to both domestic developments and international trade dynamics, the interplay between local economic indicators and global events continues to shape investor sentiment. From Malaysia's retail growth to the Philippines' post-election stock surge, the region's economic landscape remains vibrant and closely watched by investors worldwide.